- #Industry standard accounts receivable turnover how to

- #Industry standard accounts receivable turnover download

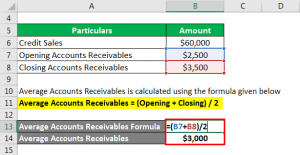

This tool enables you to quantify the cash unlocked in your company.The accounts receivables turnover is a calculation to measure how successful a company is in collecting money owed to them from customers.

#Industry standard accounts receivable turnover download

For more ways to improve your cash flow, download the free 25 Ways to Improve Cash Flow whitepaper.Īccess your Cash Flow Tuneup Execution Plan in SCFO Lab. But it also important to take a look at the numbers underlying your calculations to ensure that you have an accurate picture of a company’s performance. It is important not to just mechanically compute financial ratios such as days sales outstanding. A high DSO usually indicates inefficiencies and problems in a company which are costing a company dearly. The Problem With Days Sales OutstandingĪlthough this example is an exaggeration of extremes, the traditional DSO methodology falls short when you consider seasonality trends. Comparatively, Company B would be understated by 38 days. So for Company A, assuming the traditional DSO measure of 70 would overstate the time it would take to collect sales from the last month by two times. Meanwhile, Company B’s receivables represent sales from the past 108 days. However, Company A’s receivables are in much better condition as they only have receivables equal to the last 36 days sales (calculated as ( A/R balance/current month’s sales)*# of days in month, or To calculate the traditional DSO for both companies, divide $7,000,000 by the average daily sales for the last 12 months of $100,000. Let’s assume two situations with the following facts:Īnnual sales: $36,000,000 (or $100,000 per day)Ī/R balance at end of current month: $7,000,000

#Industry standard accounts receivable turnover how to

If you haven’t been paying attention to your cash flow, then access the free 25 Ways to Improve Cash Flow whitepaper to learn how to can stay cash flow positive in tight economies.

Managing your cash flow is vital to a business’s health. Consequently, this approach overlooks the impact seasonality of sales can have on that statistic and can sometimes provide a misleading picture of the status of accounts receivable. Unfortunately, the conventional methodology for calculating days sales outstanding weighs heavily on a company’s average annual sales, or a running 12 month average. Problem With Days Sales Outstanding Example The following days sales outstanding example highlights a common problem. It is important to understand the days sales outstanding formula and what assumptions are made in its calculation. For example, a company may also consider implementing a daily cash report to manage its cash on a daily basis, with an eye towards improving its DSO by improving its collections.

One way to monitor trends in days sales outstanding is through the use of a flash report. As a result, comparing the Days Sales Outstanding industry average with that of the company will help to gauge whether or not a company is lagging or surpassing its competitors in its accounting operations. This is especially true before they get out of hand.

Closely examine the trend in DSO over a period of weeks or months to identify problems. NOTE: Want the 25 Ways To Improve Cash Flow? It gives you tips that you can take to manage and improve your company’s cash flow in 24 hours!ĭownload The 25 Ways to Improve Cash Flowĭays sales outstanding is a measure which should be monitored often in order to gauge the efficiency and effectiveness of a company’s accounting department. Whereas a higher DSO means a longer time period to collect and usually indicates a problem with a company’s collection process and/or credit underwriting. The lower the DSO, the shorter the time it takes for a company to collect. Days sales outstanding is closely related to accounts receivable turnover, as DSO can also be expressed as the number of days in a period divided by the accounts receivable turnover. Often days sales outstanding (commonly referred to simply as DSO) is used as a measure of the average number of days it takes for a company to collect on its credit sales, using the accounts receivable balance at the end of a period and the amount of credit sales for that period. Turnover in Collections is Destroying Your DSOĭaily Sales Outstanding (DSO) Dales Sales Outstanding Explanation

0 kommentar(er)

0 kommentar(er)